Understanding Paystubs

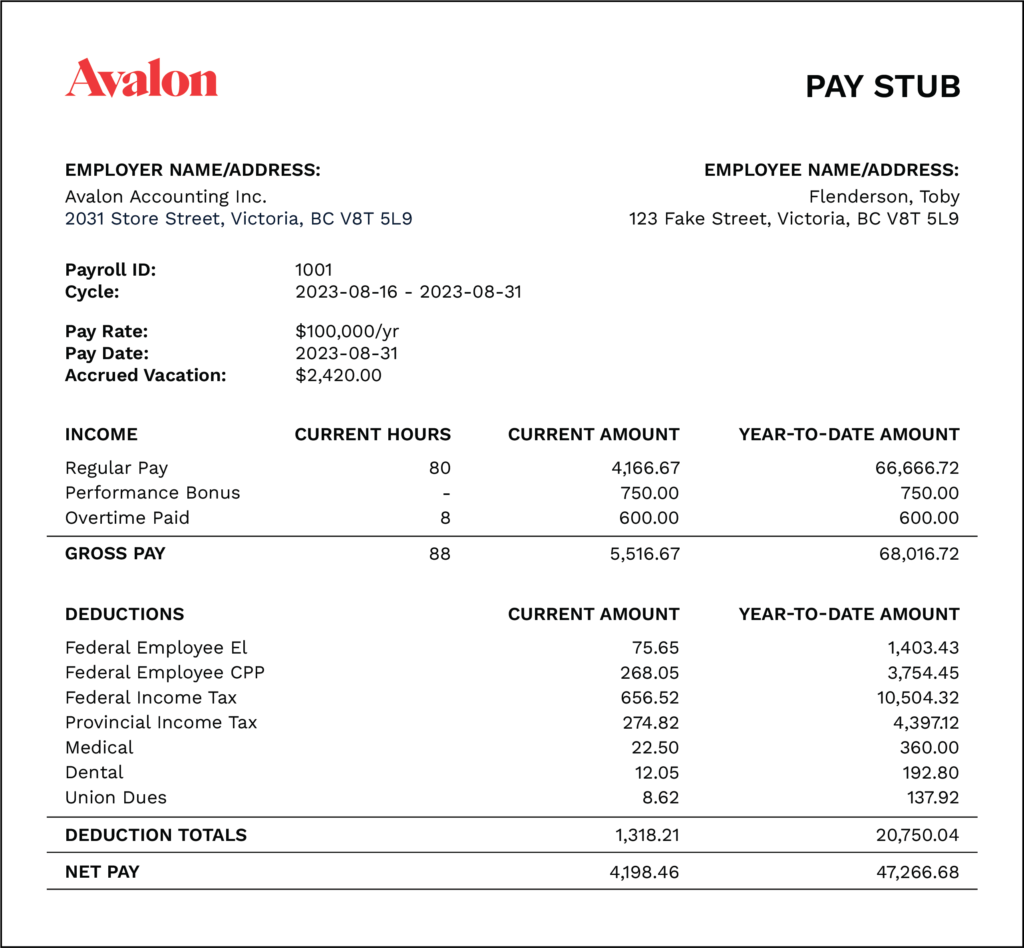

A paystub, also known as a paycheck stub or payslip, is a document provided by employers that details the earnings of an employee for a specific pay period. It typically includes vital information such as:

– **Gross Earnings**: The total amount earned before deductions.

– **Net Pay**: The final amount received after deductions.

– **Deductions**: Taxes, health insurance, retirement contributions, and other withholdings.

– **Hours Worked**: The total hours or days worked during the pay period.

– **Employer Contributions**: Any additional benefits provided by the employer.

Paystubs serve multiple purposes: they provide proof of income, are necessary for loan applications, and help employees understand their earnings and deductions better.

Why Would You Need to Edit a Paystub?

Editing a paystub can be necessary for several reasons:

1. **Correcting Errors**: Mistakes in hours worked, deductions, or gross pay can occur. It’s essential to correct these to reflect accurate earnings.

2. **Personal Records**: You may want to create a clean, organized version for personal records or for applying for loans or apartments.

3. **Financial Planning**: Adjusting figures to visualize different financial scenarios can help with budgeting or financial planning.

How to Edit a Paystub

Editing a paystub should be done cautiously and ethically. Here’s a step-by-step guide on how to edit a paystub accurately:

1. Gather Your Documents

Before making any edits, collect all necessary documents, including:

– Previous paystubs for reference.

– Your employment contract to verify pay rates and deductions.

2. Choose the Right Software

Using reliable software can simplify the editing process. Consider options like:

– **Spreadsheet Programs**: Microsoft Excel or Google Sheets for easy calculations and formatting.

– **Paystub Generators**: Online tools specifically designed for creating and editing paystubs.

3. Edit the Necessary Fields

Identify the fields that need editing. This could include:

– **Gross Earnings**: Adjust if there was an error in reported hours or pay rates.

– **Deductions**: Ensure tax rates and other deductions match your actual contributions.

– **Net Pay**: This should automatically adjust based on changes made to gross pay and deductions.

4. Double-Check Calculations

After making edits, ensure that all calculations are accurate:

– Check that gross earnings minus deductions equal net pay.

– Verify any formulas used in spreadsheet software.

5. Save and Format

Once edits are complete, save the document in a secure format. PDF is often preferred for sharing, as it preserves formatting.

6. Keep Records

Maintain copies of both the original and edited paystubs for your records. This is important for tracking income and for future reference.

Conclusion

Understanding what a paystub is and how to edit it can be invaluable for managing your finances. Whether you’re correcting an error or preparing documents for a loan application, following the above steps ensures that your paystub reflects accurate and truthful information. Always approach editing with integrity and caution to avoid potential legal issues.